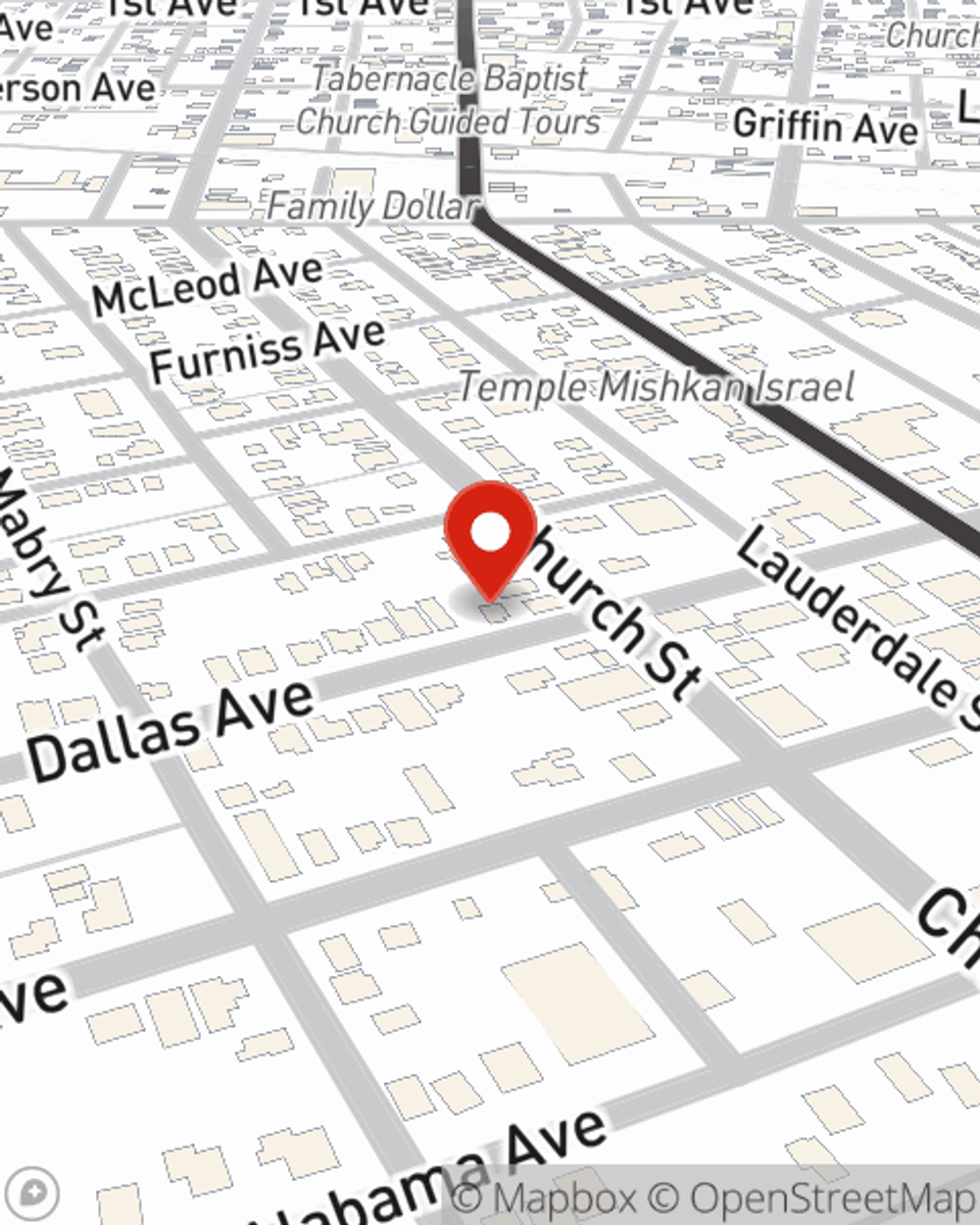

Renters Insurance in and around Selma

Get renters insurance in Selma

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Dallas County

- Perry County

- Bibb County

- Lowndes County

- Hale County

Home Sweet Home Starts With State Farm

Trying to sift through deductibles and coverage options on top of your pickleball league, managing your side business and keeping up with friends, can be time consuming. But your belongings in your rented townhome may need the impressive coverage that State Farm provides. So when the unexpected happens, your sound equipment, electronics and furniture have protection.

Get renters insurance in Selma

Renters insurance can help protect your belongings

There's No Place Like Home

Renters insurance may seem like the last thing on your mind, and you're wondering if it can actually help protect your belongings. But imagine the cost of replacing all the belongings in your rented apartment. State Farm's Renters insurance can help when abrupt water damage from a ruptured pipe damage your valuables.

As a value-driven provider of renters insurance in Selma, AL, State Farm strives to keep your valuables protected. Call State Farm agent Gus Colvin today for a free quote on a renters policy.

Have More Questions About Renters Insurance?

Call Gus at (334) 872-3441 or visit our FAQ page.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.