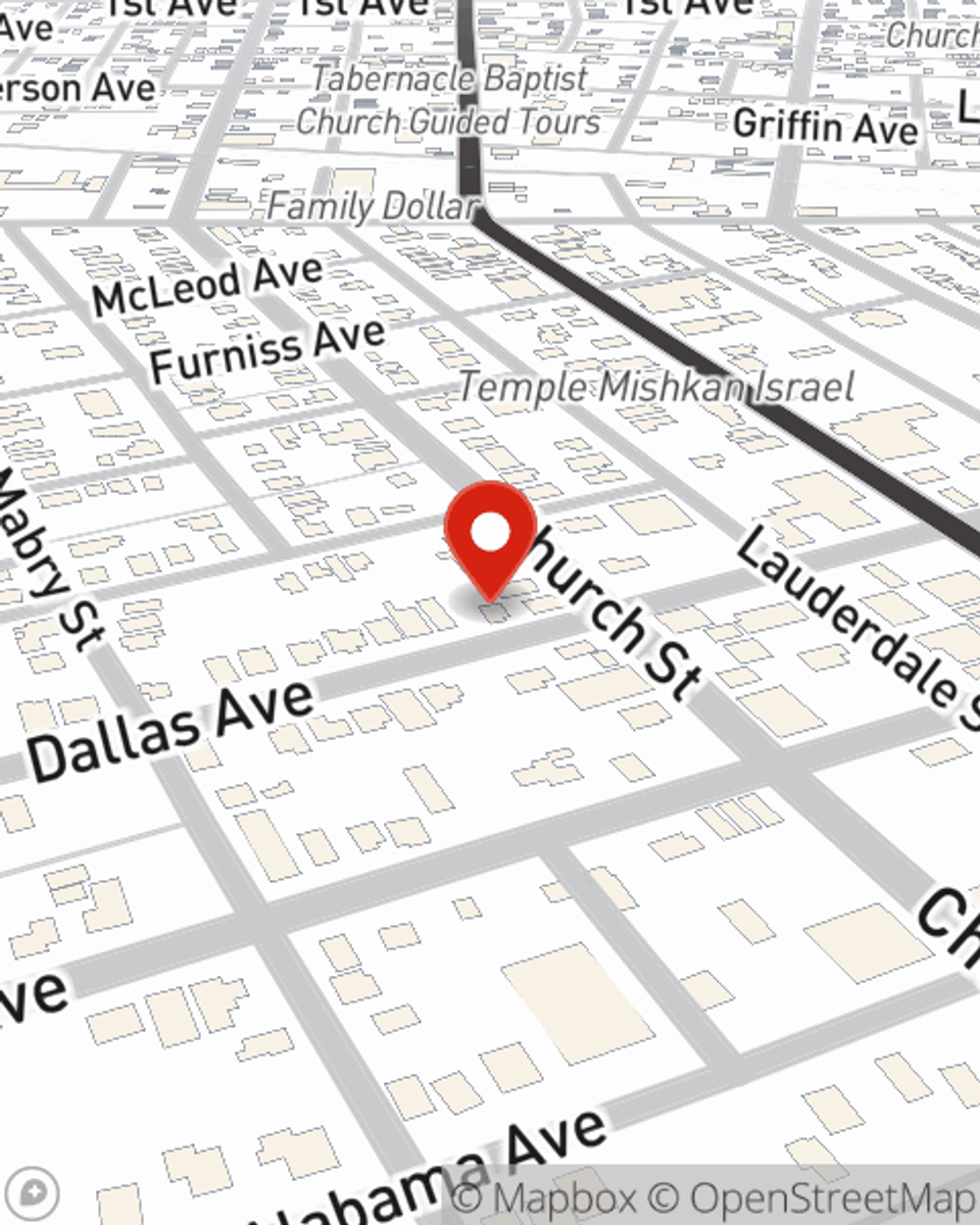

Life Insurance in and around Selma

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Dallas County

- Perry County

- Bibb County

- Lowndes County

- Hale County

Your Life Insurance Search Is Over

Buying life insurance coverage can be a lot to ponder with various options out there, but with State Farm, you can be sure to receive dependable considerate service. State Farm understands that your purpose is to help provide for the ones you hold dear.

Insurance that helps life's moments move on

Don't delay your search for Life insurance

State Farm Can Help You Rest Easy

Personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the worst comes to pass, Gus Colvin is committed to helping process the death benefit with care and consideration. State Farm has you and your loved ones covered.

It's always a good time to make sure your loved ones have coverage against the unexpected. Reach out to Gus Colvin's office to check out your Life insurance options with State Farm.

Have More Questions About Life Insurance?

Call Gus at (334) 872-3441 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Simple Insights®

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.